Халык Банк — крупнейший банк Казахстана с долей рынка 35%. MAU его мобильного приложения B2C составляет ~8 млн. MAU мобильного приложения B2B составляет ~300 тыс.+.

У Halyk Bank доверительные отношения с крупным бизнесом. Однако в сегменте малого и среднего бизнеса есть куда расти

Проблема и вохможности

Во-первых, 8 из 10 субъектов МСБ активно пользуются услугами конкурента Kaspi, а Halyk активно используют только 3 субъекта МСБ из 10

Во-вторых, темпы развития eCommerce, особенно FMCG, в Казахстане растут рекордными 12-13% второй год подряд

Решение

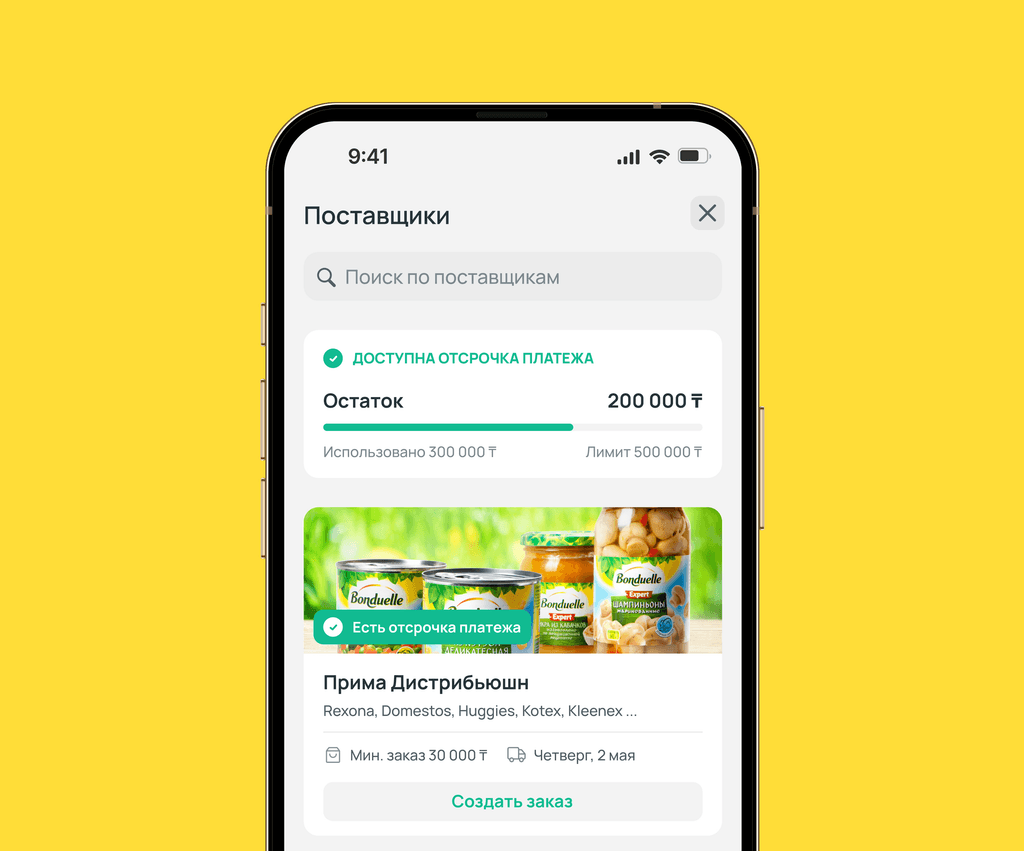

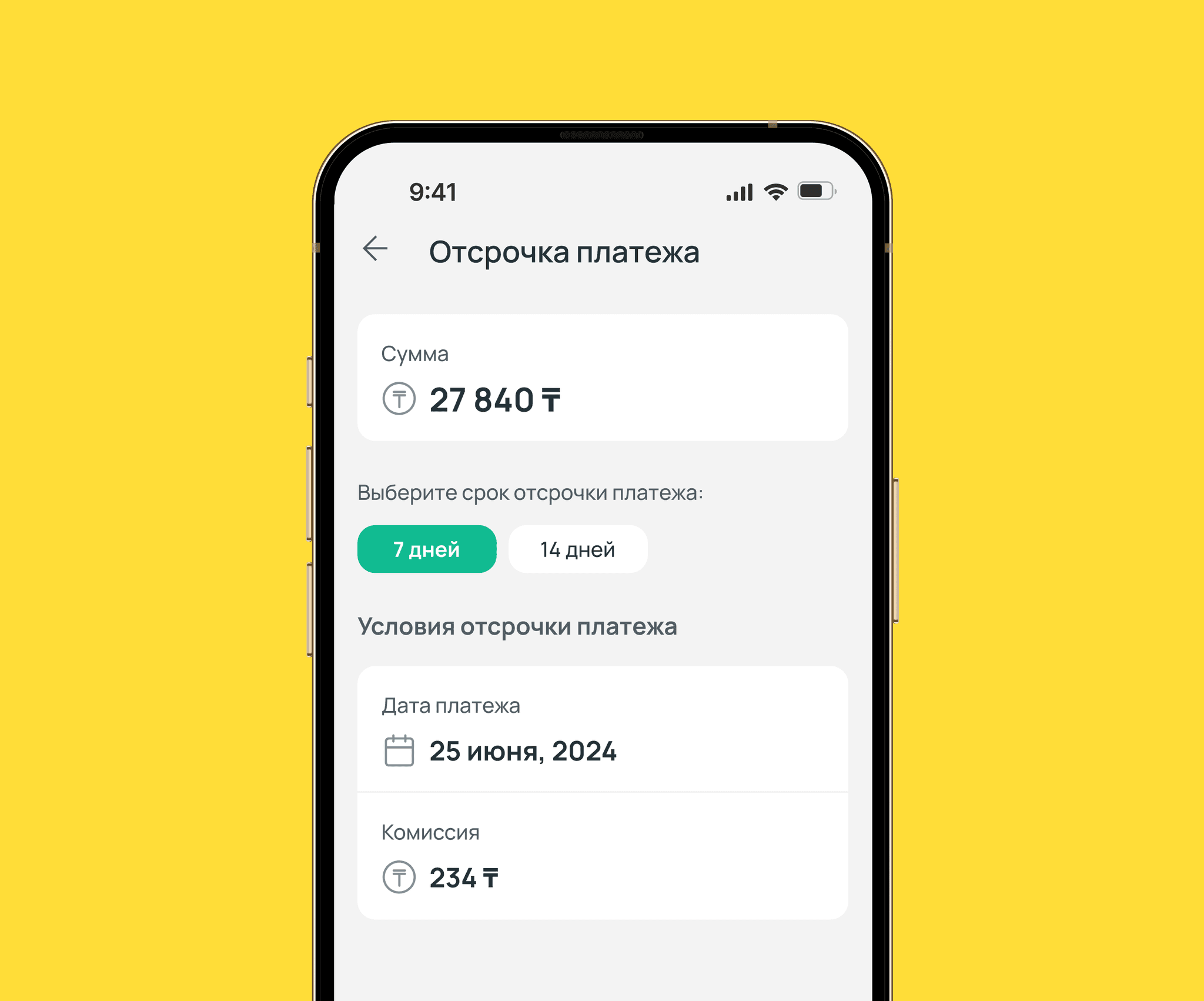

Поэтому было принято решение о сотрудничестве с McKinsey с целью увеличения клиентской базы и активности в сегменте МСБ не за счет прямого кредитования, а путем предоставления маркетплейса с возможностью отложенной оплаты

Халык Банк

получит в 2 раза больше новых бизнес-клиентов для выдачи им краткосрочных кредитов

Бизнесы

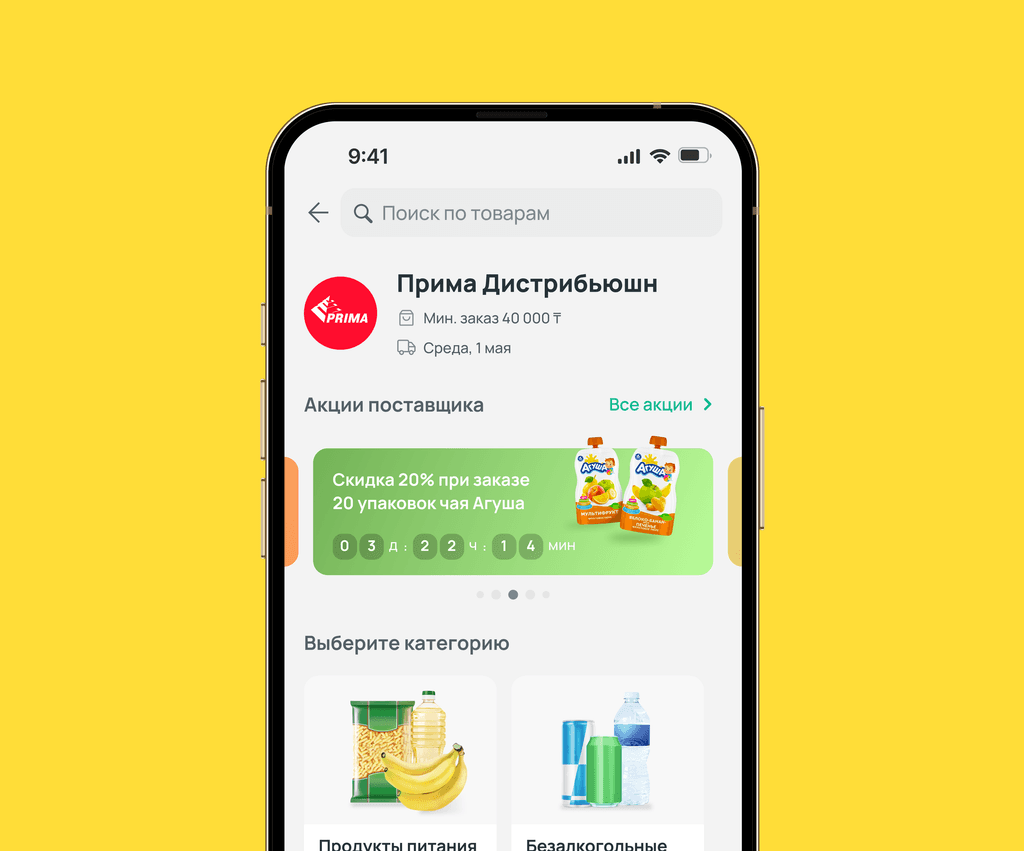

получат возможность делать заказы в любом месте и в любое время с возможностью отложенной оплаты

Дистрибьюторы

благодаря цифровизации получат более прозрачные процессы и лучшее отслеживание продаж и тенденций